Application for Bank Statement: A Comprehensive Guide

A bank statement is a detailed record of all the transactions that have occurred on a bank account over a specific period of time. It typically includes information such as the date and amount of each transaction, the type of transaction, the other party involved, and the remaining balance in the account. Bank statements can be used for a variety of purposes, such as tracking spending, reconciling accounts, and applying for loans.

Types of Bank Statements

There are two main types of bank statements:

- Mini-statements: Mini-statements are abbreviated versions of bank statements that typically only show the most recent transactions. They can be obtained at ATMs or through online banking.

- Full bank statements: Full bank statements show all of the transactions that have occurred on an account over a specified period of time. They can be obtained by visiting a bank branch, requesting them by mail, or downloading them online.

How to Request a Bank Statement

There are a few different ways to request a bank statement:

- Visit a bank branch: You can visit a bank branch and speak to a customer service representative to request a bank statement. They will typically be able to provide you with a copy of your most recent mini-statement or full bank statement immediately.

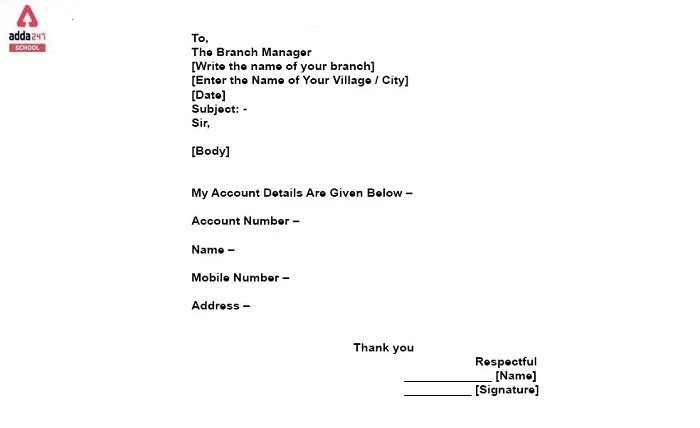

- Request a bank statement by mail: You can request a bank statement by mail by writing a letter to your bank branch. In your letter, be sure to include your account number and the date range for the statement you would like to receive.

- Download a bank statement online: Most banks allow you to download bank statements online through their website or mobile app. To do this, you will typically need to log in to your account and navigate to the section where bank statements are stored.

Fees for Bank Statements

Some banks charge a fee for bank statements, especially if you request a physical copy to be mailed to you. The amount of the fee will vary depending on the bank. However, many banks do not charge a fee for electronic bank statements.

Reasons for Requesting a Bank Statement

There are many different reasons why someone might need to request a bank statement. Some common reasons include:

- To track spending: Bank statements can be used to track spending over a period of time. This can help people identify areas where they can cut back or budget more effectively.

- To reconcile accounts: Bank statements can be used to reconcile bank accounts with other financial records, such as a checkbook or personal accounting software. This can help ensure that all transactions are accounted for and that the account balance is accurate.

- To apply for loans: Many lenders require applicants to provide bank statements as proof of income and financial stability. Bank statements can also be used to verify employment and other information.

- For tax purposes: Bank statements can be used to prepare tax returns and to support any deductions or credits that are claimed.

- To investigate fraud or errors: If you suspect that there has been fraud or an error on your bank account, you can request a bank statement to review your transactions.

How to Read a Bank Statement

Bank statements can be confusing at first glance, but they are relatively easy to understand once you know what to look for. Here is a breakdown of the different sections of a typical bank statement:

- Account information: This section includes information about your bank account, such as the account number, account type, and account holder name.

- Statement period: This section shows the date range for the bank statement.

- Beginning balance: This shows the balance in your account at the beginning of the statement period.

- Transactions: This section lists all of the transactions that occurred on your account during the statement period. For each transaction, the statement will show the date, amount, type of transaction, and other party involved.

- Ending balance: This shows the balance in your account at the end of the statement period.

Conclusion

Bank statements are an important financial tool that can be used for a variety of purposes. By understanding how to read and request a bank statement, you can better manage your finances and protect yourself from fraud.

Here are some additional tips for using bank statements effectively:

- Use your bank statement to create a budget. This will help you track your spending and make sure that you are not overspending in any one area.

- Reconcile your bank statement with your checkbook or personal accounting software every month. This will help you identify any errors or discrepancies.

- Keep your bank statements on file for at least three years. This will come in handy if you need to prove your income or assets for a loan or other financial transaction.

- Be sure to review your bank statements regularly for any unusual activity. If you spot something that you don’t recognize, contact your bank immediately.

By following these tips, you can use bank statements to your advantage and improve your financial health.

FAQ

Q: How often should I review my bank statements?

A: It is important to review your bank statements regularly to track your spending, reconcile your accounts, and identify any unusual activity. You should also review your bank statements before applying for a loan or opening a new bank account.

Q: What should I do if I spot an error on my bank statement?

A: If you spot an error on your bank statement, you should contact your bank immediately. They will be able to investigate the error and correct it if necessary.

Q: How can I protect my bank statements from identity theft?

A: It is important to protect your bank statements from identity theft. Here are a few tips:

- Shred old bank statements before discarding them.

- Do not leave bank statements in plain sight in your home or car.

- Be careful about who you share your bank statement information with.

- Consider using